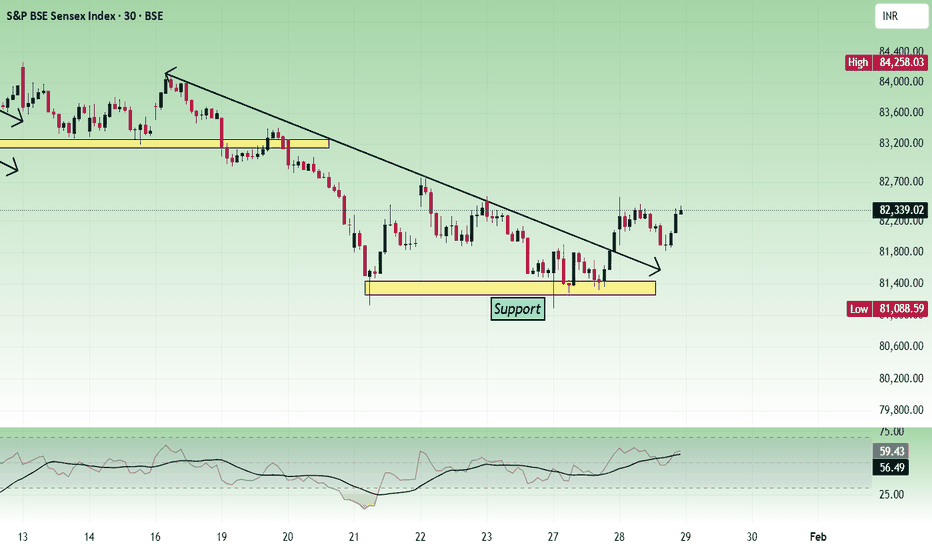

If you are wondering why market fall today and why Sensex is falling despite a positive Economic Survey, the answer lies in three key factors: heavy foreign investor selling, rupee weakness, and profit booking ahead of the Union Budget. At around 9:30 am, the S&P BSE Sensex was down 516.43 points at 82,049.94, while the NSE Nifty50 slipped 192.75 points to 25,226.15. Investors chose caution over optimism, even as growth projections remained strong.

The broader mood suggests risk reduction rather than panic.

Why Market Is Falling Today Despite Strong Economic Survey

A natural question is: why market is falling today when the Economic Survey projects healthy growth?

The Survey indicated:

- GDP growth between 6.8% and 7.2% in FY27

- Headline inflation around 3.5%

- Nominal GDP growth close to 10%

On paper, these are supportive indicators. Strong nominal growth can translate into corporate earnings expansion of 15–17%.

However, markets operate on expectations, not just data. In the short term, investors are focusing on:

- Global geopolitical risks

- Tariff uncertainties

- Rising crude oil prices near $70 per barrel

- Budget-related policy uncertainty

In Hindi, keh sakte hain ki “numbers positive hain, lekin sentiment cautious hai.” Growth projections provide medium-term comfort, but immediate triggers are driving volatility.

Why Did Market Fall Today? FII Selling Continues

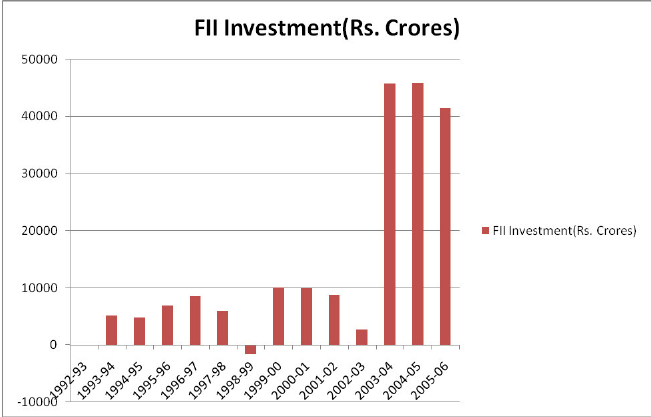

Another major reason why did market fall today is continued foreign portfolio investor outflows.

Foreign investors have sold Indian equities worth Rs 43,686.59 crore in January so far. In 2025, cumulative outflows have reached nearly $19 billion.

On January 29 alone:

- Foreign institutional investors sold shares worth Rs 394 crore

- Domestic institutional investors bought equities worth Rs 2,638 crore

This divergence highlights a structural shift. While domestic investors are stepping in, foreign selling creates pressure on frontline indices.

Why does FII selling matter?

- Large-cap stocks see direct impact

- Index-heavy counters decline

- Market sentiment weakens

- Currency pressure increases

When foreign capital exits, volatility rises.

Why Sensex Is Falling and Why Nifty Is Falling Today

The fall is not limited to one or two stocks. The weakness is broad-based.

At early trade:

- Sensex dropped over 500 points

- Nifty50 fell nearly 200 points

- Nifty Metal declined around 4–5%

- Nifty IT slipped over 1.5%

Metal stocks were hit hardest. After a strong three-day rally of nearly 9%, investors booked profits. Weak global commodity prices added to selling pressure.

IT stocks also declined:

- HCL Technologies fell around 2%

- Infosys dropped 1.68%

- TCS slipped 1.26%

- Tech Mahindra eased 1.16%

Meanwhile, defensive sectors such as FMCG and Pharma showed resilience.

The answer to why stock market is falling lies partly in sector rotation. Investors are reducing exposure to cyclical and high-beta sectors ahead of key events.

Why Share Market Is Going Down Today: Rupee Pressure Adds Stress

Currency weakness is another factor behind why share market is going down today.

The rupee opened at 91.9125 against the US dollar, close to record lows. It had touched an all-time low of 91.9850 recently.

So far this month, the rupee is down about 2.3%, marking one of its weakest performances since September 2022.

Why does a falling rupee matter?

- Import costs rise

- Inflation risks increase

- Corporate margins get squeezed

- Foreign investors become cautious

Although currency depreciation is not unique to India, countries with current account deficits tend to face added pressure.

A weaker rupee often amplifies equity volatility.

Why Is Indian Stock Market Falling Before Budget?

As Budget Day approaches, investors are reducing risk exposure.

Ahead of major policy announcements, market participants typically:

- Lock in profits

- Reduce leveraged positions

- Shift towards defensive sectors

- Avoid fresh aggressive buying

Volatility indicator India VIX rose by over 3%, reflecting rising uncertainty.

Midcap and smallcap indices also declined:

- Nifty Midcap 100 fell 1.07%

- Nifty Smallcap 100 slipped 1.41%

Broader markets tend to react more sharply during cautious phases.

In simple terms, investors are waiting for clarity.

Sector-Wise Snapshot: Who Gained, Who Lost?

While most indices traded in the red, some pockets showed stability.

Sectoral Performance Snapshot

| Sector | Performance Trend |

| Nifty Metal | Down ~4–5% |

| Nifty IT | Down ~1.5% |

| Nifty Auto | Down ~0.5% |

| Nifty Financial Services | Down ~0.6% |

| Nifty Realty | Down ~1.1% |

| Nifty FMCG | Slightly Positive |

| Nifty Pharma | Marginal Gains |

On the Sensex:

- ITC gained 0.88%

- Hindustan Unilever rose 0.74%

- Asian Paints added 0.71%

- Sun Pharma gained 0.70%

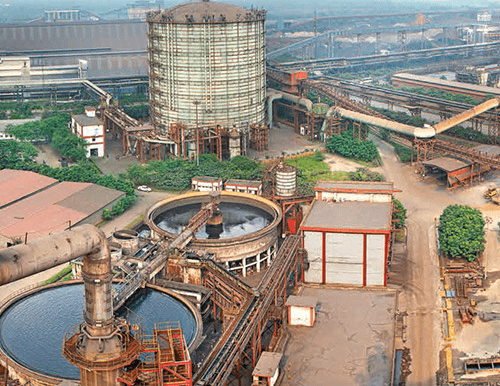

On the losing side:

- Tata Steel fell 3.34%

This reflects defensive buying alongside cyclical selling.

Global Headwinds Behind Why Today Share Market Down

Markets are also reacting to global cues.

Key concerns include:

- Tariff threats affecting global trade

- Brent crude oil hovering near $70

- Uncertainty around US monetary policy

- Weak global commodity prices

Higher oil prices affect India’s macro stability since the country is a major crude importer.

When oil rises:

- Input costs increase

- Fiscal pressure builds

- Inflation risks climb

Investors price in these risks quickly.

Is This a Correction or Structural Weakness?

The current fall appears more like consolidation rather than panic.

Recent sessions saw steady gains. After three straight positive days, profit booking was expected.

Market experts suggest:

- Near-term volatility likely

- Medium-term growth outlook intact

- Earnings trajectory supportive

If foreign outflows slow and Budget measures provide clarity, stability may return.

However, in the short term, investors are cautious.

What Should Investors Do Now?

For retail investors asking why today share market down and what to do next, the answer depends on strategy.

Short-term traders should:

- Avoid chasing recoveries

- Maintain disciplined stop-losses

- Track global cues closely

Long-term investors should:

- Focus on earnings visibility

- Prefer quality sectors

- Maintain diversification

In Hindi, samajhna zaroori hai ki “har girawat crisis nahi hoti.” Not every decline signals structural trouble.

Why Market Fall Today Explained

To summarise why market fall today:

- Continued FII selling worth over Rs 43,000 crore this month

- Weak rupee near record lows

- Profit booking ahead of the Union Budget

- Sector-specific selling in metals and IT

- Global trade and oil-related uncertainties

The Economic Survey offers medium-term optimism, but near-term caution dominates sentiment.

Markets remain sensitive to global and domestic triggers. Clarity from the Budget and stabilisation in foreign flows may determine the next direction.

For now, volatility is the key theme.