The sharp market fall today followed Finance Minister Nirmala Sitharaman’s Union Budget 2026 speech, which triggered a steep sell-off in equities. Nifty50 dropped 593 points to close at 24,825.45, down 2.33 percent, while BSE Sensex plunged 1,843 points to settle at 80,722.94, a fall of 2.23 percent. The key trigger was the unexpected hike in Securities Transaction Tax (STT) on futures and options trades. While investors are asking, “Is the stock market crashing?”, analysts suggest this is a strong knee-jerk reaction rather than a systemic collapse.

The immediate sentiment was negative, especially in derivatives-linked counters and brokerage stocks, as markets recalibrated to higher transaction costs.

Why the Market Fall Today After Budget 2026 Speech?

The primary reason behind the market fall today was the government’s decision to increase STT on futures and options. The hike came at a time when markets were expecting relief in capital gains taxation.

Finance Minister Sitharaman announced:

- STT on Futures raised to 0.05 percent from 0.02 percent

- STT on options premium increased to 0.15 percent from 0.1 percent

- STT on exercise of options raised to 0.15 percent from 0.125 percent

This announcement surprised traders. According to Narendra Solanki, Head Fundamental Research at Anand Rathi Share and Stock Brokers Limited, markets reacted sharply because expectations were already priced in. Investors had hoped for capital gains tax relief, which did not materialize.

What Is STT and Why Does It Matter?

STT, or Securities Transaction Tax, is a levy imposed on every buy and sell transaction in the equity and derivatives market. Though the percentage appears small, the impact compounds for active traders.

For example:

- High-frequency traders execute multiple trades daily.

- Hedgers and arbitrage participants rely on narrow margins.

- Brokers generate revenue from derivatives volumes.

When STT rises, transaction costs increase immediately. In Hindi, seedha matlab hai — trading mehenga ho gaya. Higher cost means lower profitability for short-term participants.

Importantly, the hike applies only to futures and options, not cash equity trades. However, since derivatives drive a large share of trading volume, the sentiment impact was broad.

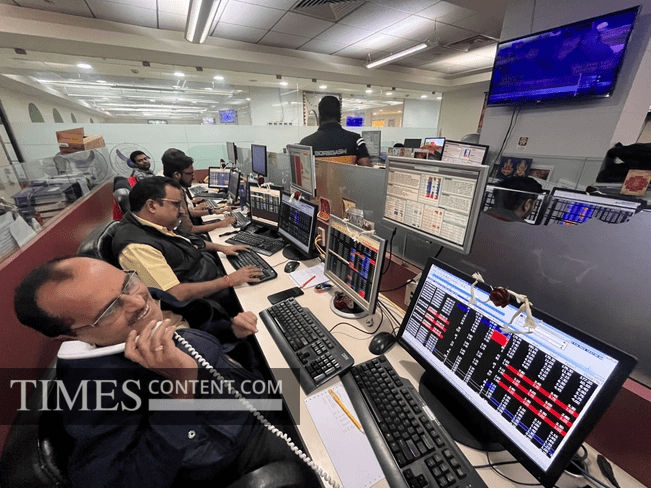

BSE Share News: Brokerage Stocks Lead the Decline

BSE share news remained in focus as exchange-related and brokerage stocks saw steep corrections.

Shares of:

- BSE Ltd dropped to an intraday low of Rs 2,517.30

- Angel One fell to Rs 2,284.70

- Billionbrains Garage Ventures, parent of Groww, declined sharply

Some of these counters fell by as much as 13.5 percent.

The reason is straightforward. Higher STT may reduce derivatives volumes, which directly affects brokerage revenues. When trading slows, exchange income also moderates.

Heavyweights Deepen the Fall

The selling pressure was not confined to brokerage counters. Large-cap stocks contributed significantly to the decline.

- Reliance Industries fell about 2.5 percent

- State Bank of India dropped nearly 5 percent

When heavyweight stocks decline, indices feel amplified pressure. As a result, the fall appeared broader and sharper.

Small-cap stocks dropped around 3 percent, while the midcap index declined roughly 2 percent. This shows that risk aversion was widespread.

Is the Stock Market Crashing or Just Correcting?

The question dominating investor discussions is clear: Is the stock market crashing?

Based on current data, the answer leans toward a corrective reaction rather than a structural crash. The fall is linked to a policy announcement affecting transaction costs, not a banking crisis or macroeconomic shock.

Shripal Shah, Managing Director and CEO of Kotak Securities, noted that the steep STT increase could dampen derivatives activity. However, he also observed that the government’s aim may be to curb excessive speculation rather than maximize tax revenue.

If derivatives volumes drop, additional revenue from higher STT could be offset by reduced participation.

In practical terms, this is a policy-driven repricing event.

Sector-Wise Impact After Budget 2026

While markets reacted negatively overall, certain sectors may remain resilient.

Somil Mehta, Head of Retail Research at Mirae Asset Sharekhan, pointed out that the Budget continues to support infrastructure, manufacturing, and digital-led themes.

Potentially resilient sectors include:

- Railways

- Electronics manufacturing

- Semiconductors

- Pharmaceuticals

- Metals and mining

- Data centers

These sectors benefit from policy visibility and structural growth drivers.

Comparison: Pre- and Post-Budget Market Snapshot

Table: Market Reaction Summary

| Indicator | Before Budget Speech | After Budget Close |

| Nifty50 | Above 25,400 approx | 24,825.45 (-593 pts, -2.33%) |

| BSE Sensex | Above 82,500 approx | 80,722.94 (-1,843 pts, -2.23%) |

| Small Cap Index | Stable | Down ~3% |

| Midcap Index | Moderate | Down ~2% |

This snapshot highlights how quickly sentiment shifted following the announcement.

Role of Capital Gains Tax Expectations

Another factor behind the market fall today was the absence of capital gains tax relief. Markets had priced in possible changes to LTCG and STCG rates.

When such expectations are not met, disappointment often triggers selling.

Additionally, foreign institutional investors (FIIs) may reassess allocations if post-tax returns appear less attractive.

Thus, the fall was not caused by one factor alone but by a combination of:

- STT hike

- No capital gains relief

- Existing market volatility

What Should Investors Do Now?

In times like these, panic decisions can be costly. A disciplined approach is essential.

Analysts suggest:

- Avoid aggressive short-term derivative bets.

- Focus on quality stocks with strong balance sheets.

- Maintain diversification across sectors.

- Consider defensive allocation.

In Hindi, sabse zaroori baat hai — ghabrahat mein decision na lein. Markets react sharply in the short term but often stabilize once clarity emerges.

Long-term investors may treat corrections as accumulation opportunities, provided fundamentals remain intact.

Broader Outlook for Indian Equity Markets

Despite the immediate downturn, the Budget emphasizes infrastructure spending, manufacturing growth, and digital expansion. These themes align with India’s medium-term growth strategy.

However, near-term volatility may persist due to:

- FII flows

- Derivatives activity slowdown

- Global economic signals

Markets operate on expectations. When policy surprises occur, repricing follows.

The key will be whether volumes normalize and whether corporate earnings continue to support valuations.

Market Reaction, Not Collapse

The market fall today reflects a sharp response to higher STT on futures and options after the Budget 2026 speech. Nifty50 and BSE Sensex saw over 2 percent declines, with an 1,800-point drop in Sensex highlighting the intensity.

However, current indicators do not confirm a systemic crash. The reaction appears policy-driven and sentiment-based.

Investors should stay measured, track sectoral opportunities, and avoid overreacting to short-term turbulence. Markets adjust to new realities. Stability often returns once clarity replaces uncertainty.